Fossil Foundations: The Uneven Architecture of Global Power

The energy transition isn't failing - it's fracturing. This report decodes where power still lies, and where capital will rotate next.

GLOBAL CONTEXT

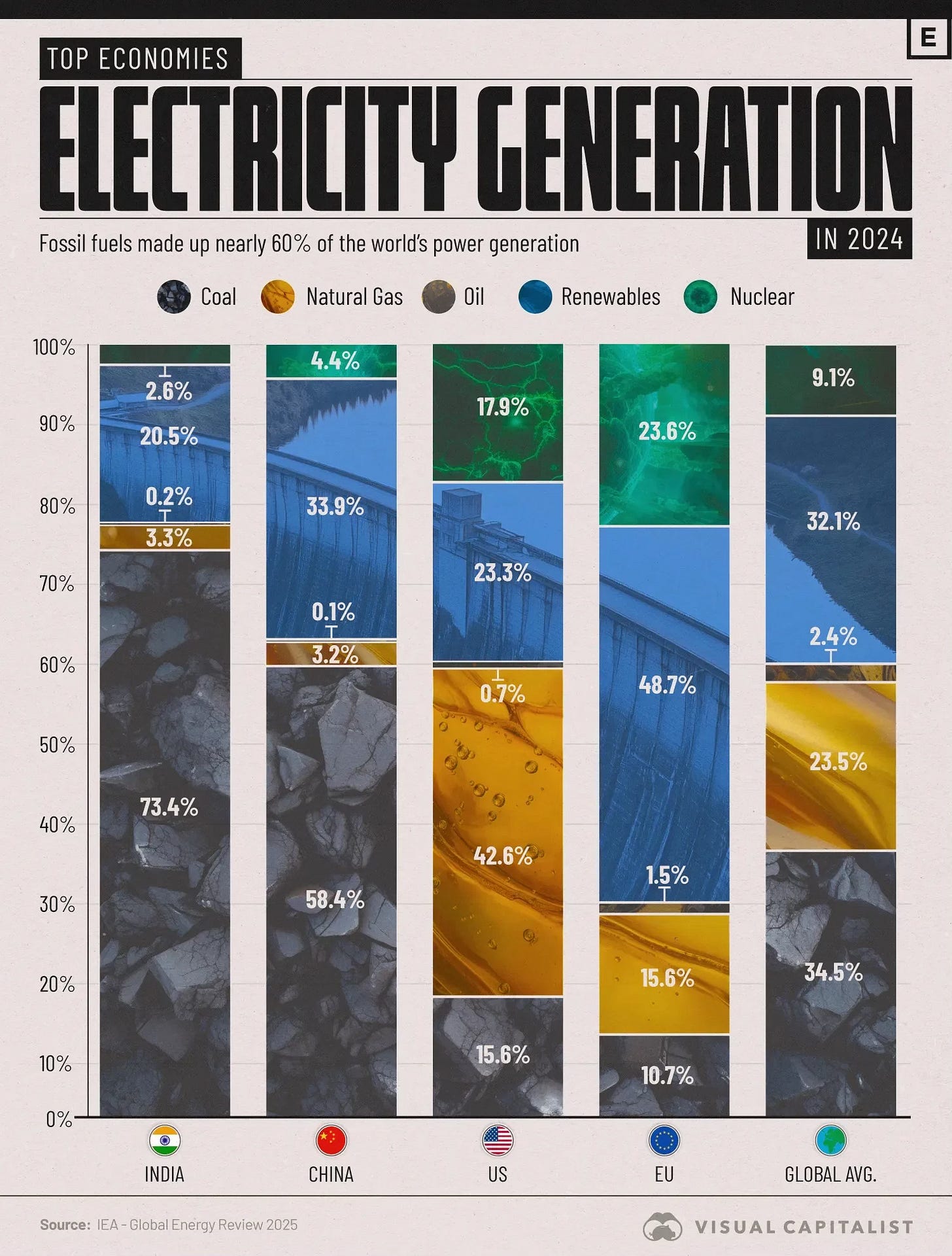

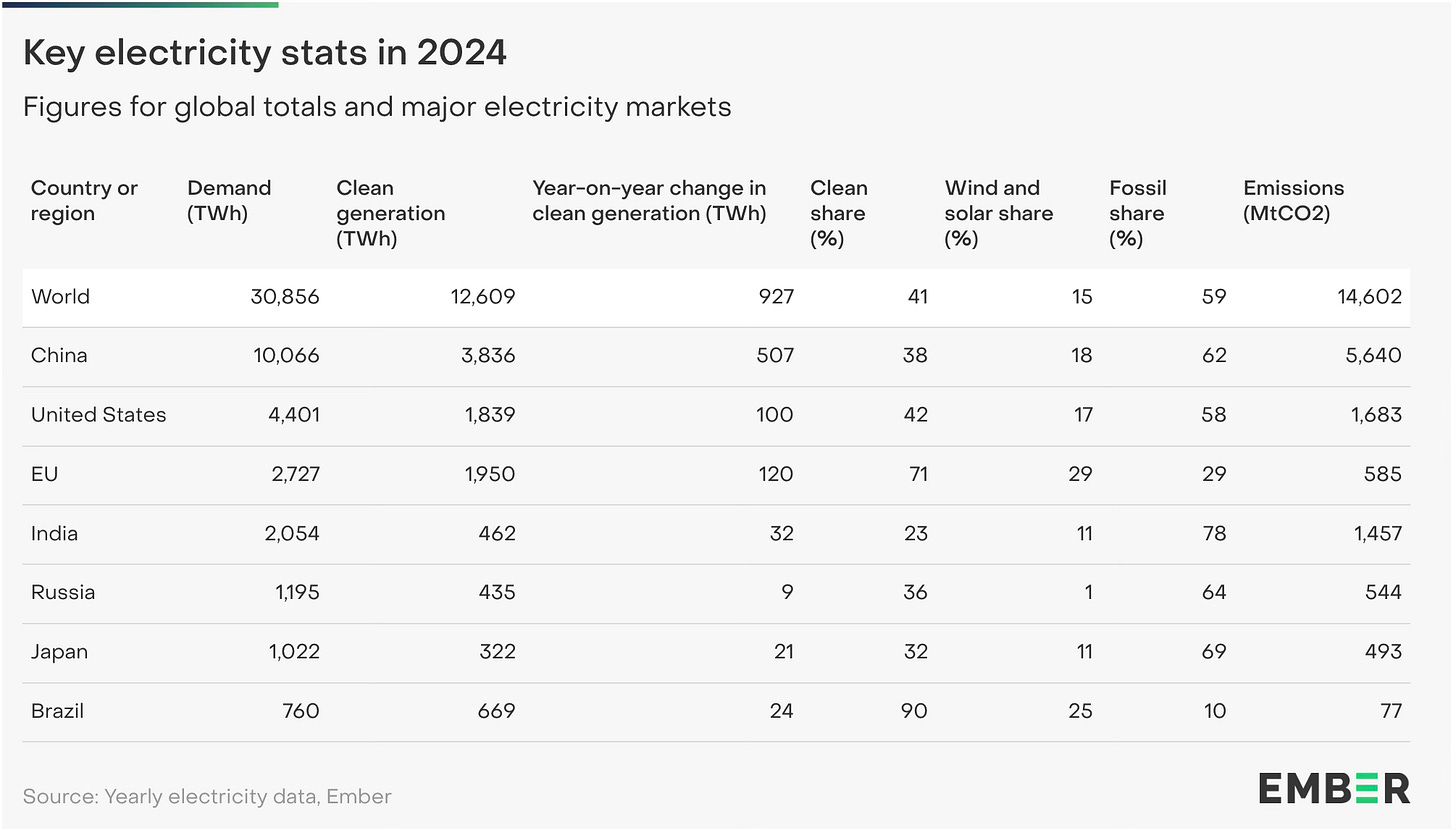

In 2024, fossil fuels still generate nearly 60% of the world’s electricity. The illusion of a seamless energy transition is cracked by data, not ideology.

Global electricity generation by fuel type. Fossil fuels remain the backbone of power supply despite policy shifts.

REGIONAL BREAKDOWN: A FRAGMENTED TRANSITION

Different regions are not just moving at different speeds—they’re playing entirely different energy games:

🇮🇳 India: Coal provides 73.4% of electricity. The priority isn’t decarbonization—it’s affordability and reliability for a rapidly urbanizing population. India is focused on expanding transmission, not exiting fossil.

🇨🇳 China: Despite scaling solar and hydro, coal still supplies 58.4% of the grid. Fossil fuels are viewed as strategic insurance—ensuring self-sufficiency and energy security.

🇺🇸 United States: Natural gas leads at 42.6%, driven by the shale boom. While renewables are rising, fossil exports (especially LNG) and grid stability drive national priorities.

🇪🇺 European Union: A clear outlier. With 48.7% renewables and 23.6% nuclear, the EU is decarbonizing faster—fueled by carbon pricing (EU ETS), Green Deal subsidies, and CBAM (carbon import tax).

Electricity mix by region. The energy transition is not universal—it’s asymmetric by design and necessity.

ENERGY, SOVEREIGNTY & INFRASTRUCTURE

The path to net-zero is not linear—it’s a fragmented chessboard. Infrastructure gaps, political constraints, and economic priorities continue to shape each region’s approach.

In the West, policy and capital drive decarbonization.

In the Global South, sovereignty, affordability, and reliability take precedence.

This divergence has structural consequences for trade, capital flows, and geopolitical influence.

THE CARBON ARBITRAGE BEGINS

This asymmetry is not just political—it’s financial.

As carbon pricing mechanisms like CBAM roll out, exporters in high-emissions sectors (steel, cement, aluminum) will face increasing penalties.

The arbitrage? Capital will rotate out of fossil-intensive exporters and into decarbonization infrastructure.

Carbon pricing is becoming a trade lever. The energy transition will reward enablers, punish emitters.

CBAM doesn’t just tax emissions-it taxes emission delays. Companies including JSW Steel , Tata Steel, and Vale face mounting regulatory costs unless their Scope 1 and 2 emissions fall sharply before 2030. The wide spread in targets- from 20% to 100%- reflects not only regional disparities, but strategic risk exposure

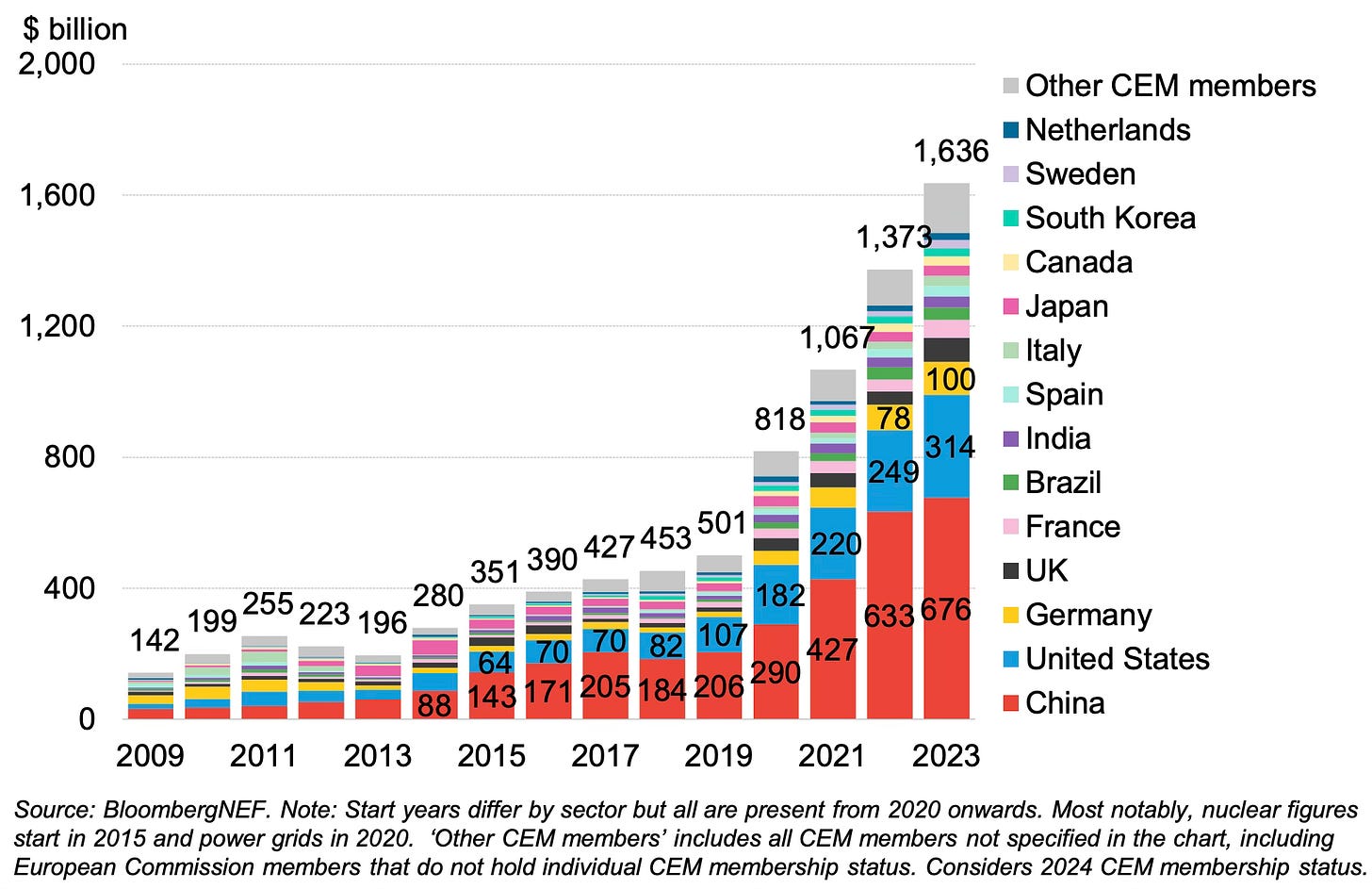

WHERE CAPITAL WILL FLOW NEXT…. ALREADY $8.3 TRILLION

The winners won’t be ideological.They will be positioned for structural resilience and policy leverage

The energy revolution won’t be won in wind farms - it will be won in the infrastructure behind them. As policy moves from ambition to enforcement, the capital rotation is already underway:

Grid Modernization: Renewable generation means nothing without delivery. Grid infrastructure is the global bottleneck. According to BNEF, average investment needs to rise from $392B/year to $738B/year by 2030 to stay on the Net Zero track.

Energy Storage: Utility-scale battery capacity doubled in 2023 across Clean Energy Ministerial (CEM) members. China alone added 22GW. Storage is the key enabler for intermittent power — and the next frontier for infra capital.

Transmission Infrastructure: India and China now invest more in grid expansion than new fossil capacity. Expect transmission to become a leading allocation area across emerging markets as electrification accelerates.

Carbon Compliance Tech: Carbon accounting, embedded emissions tracking, and ESG reporting are becoming trade enablers. CBAM is the first major mechanism, but others will follow. The regulatory “rails” for decarbonized trade are still being laid — and investment will follow.

Policy Arbitrage Markets: Countries like Brazil, Indonesia, and sub-Saharan African nations aren’t racing to net-zero — they’re leveraging delay. As the West prices carbon into trade, the Global South becomes a strategic zone for subsidy capture, resource premiums, and FX defense.

The winners won’t be ideological.They will be positioned for structural resilience and policy leverage…

Capital will chase scalable infrastructure—not just generation.

The next energy revolution won’t be ideological. It will be financial, regional, and strategic. In the new energy order, capital will chase resilience—not virtue.